Recession pressures, more cash on hand and a quest for new markets quickly kicked mergers and acquisitions out of the gate in 2010. More reasonable corporate valuations will fuel activity, say M&A watchers, but the economic climate could still hinder deal-making.

“This year is off to a strong start with notable deals in the energy, health-care, security and infrastructure sectors,” says M&A consulting firm Morrissey Goodale, noting 10 deals announced in the first two weeks of January. His firm tracked 230 deals in 2009, he says, slightly off the 300 recorded the previous year.

Steve Gido, M&A expert at management consultant ZweigWhite, says buyers will be attracted by lower valuations, potential acquisitions in distressed or changing markets and those with credit-access challenges. He says predicted tax increases in 2011, such as higher capital gains taxes, could propel more sales action this year. “Many firms are talking and strategizing, but I think the bulk of the deals will continue to be niche and tuck-ins, as many buyers still don’t want to take on much risk” until the national and industry economic outlook is clearer, says Gido.

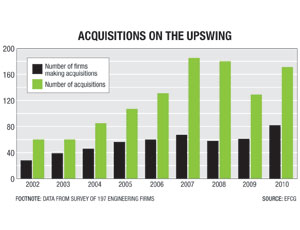

Paul Zofnass, president of management consultant EFCG Inc., predicts strong M&A activity fueled by slowing operations that generate higher cash reserves for buyers, as well as growing interest in the U.S. engineering-construction marketplace from overseas acquisitors and from private-equity firms that, he says, see long-term sector-growth potential.

EFCG Vice President Andrej Avelini says the current economic climate could make deal-making tougher, noting buyers are more wary “about a seller’s ability to return their earnings to what they had been in the past.” He says lower earnings for some firms, compared to past years, is creating a wider “valuation gap” between buyers and sellers. The question is how many firms “will return to the financial performance of 2007 and 2008, or is 2009 a more representative year for the next couple of years?” says Avelini.

Post a comment to this article

Report Abusive Comment