Who owns your data? If you own a new Link-Belt crane, you do, according to Bill Stramer, vice president of marketing for the Lexington, Ky.-based manufacturer. As global crane owners are cautiously adopting telematics to manage maintenance, safety, geography and other risks, manufacturers such as Link-Belt are grappling with how to provide machine data in the absence of a wide-reaching industry standard.

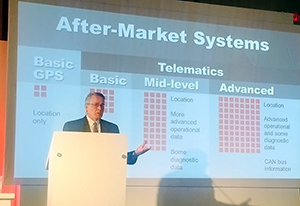

Telematics, or the long-distance transmission of computer-based information, is a “tremendous opportunity to enhance your fleet management and, ultimately, your fleet performance,” said Stramer, who addressed 260 crane owners, suppliers and users on Nov. 12 at the World Crane and Transport Summit in Miami. But fleet owners have been cautious to adopt it, and those who have adopted it use data in many different ways, complicating the manufacturer’s job in serving up the information.

“My experience is, if you ask 10 customers what they want to do with their telematics data, you are going to get 10 completely different answers,” Stramer said.

Openness made sense for Link-Belt, now in its 140th year of operation. Instead of baking its own proprietary telematics system into its machines, Link-Belt earlier this year partnered with A1A Software LLC to introduce iCraneTrax, a third-party platform supplied on all new Link-Belt machines. The device also can be retrofitted on other makes and models, too.

“One of the biggest mistakes we could have made would have been to develop something too specialized, too hard to deal with, too complicated and less customer-friendly,” Stramer said.

A1A tracks inputs such as machine location, component hours and maintenance intervals and pulls this info from all Tier 4 Final-equipped machines at no up-front cost, Stramer said. Users then receive one free year of basic service from A1A as part of their crane purchase. After that, subscription fees cost $25 per month per unit in the U.S. and $31 per month per unit outside of the U.S.

For advanced users, iCraneTrax can pull more than 175 data points and hundreds of fault codes to integrate that data with enterprise software systems, helping owners to plan fleet maintenance, keep tabs on client use, dispatch jobs and conduct billing. That level of service costs $1,000 per year for up to five company users.

Although the Association of Equipment Management Professionals and the Association of Equipment Manufacturers this year jointly developed a telematics standard, which is awaiting international certification, they did not involve crane producers in the process. Stramer said Link-Belt and other crane makers hope to be included in future versions. However, Stramer noted that iCraneTrax's existing data already maps over to the forthcoming standard, he added.

Beyond engine upkeep, telematics usage is seen as an emerging tool for managing other aspects of the capital-intensive and risky crane business. Link-Belt’s telematics system does not track all the specific lifting information stored in the crane’s data logger, which the manufacturer typically interprets at the owner’s request, but some limited information is provided.

A Link-Belt machine now can report to owners in what percentage of the unit’s capacity chart it has operated recently and alert the owner in the event of a potential overload situation. Pushing into the cloud more detailed information on every pick—such as load weight, radius, boom length and winch movement—would require much wider bandwidth and subscription fees, said Tawnia Weiss, president of A1A.

“It’s a huge amount of data,” Weiss said, adding, “The crane industry is in its infancy with telematics.” In terms of privacy, however, the A1A system allows crane owners to decide—at any time—with whom to share their data.

"You can decide from the very first moment if you want to share your data or not," Stramer said.

Sip or Gulp It?

Likening the telematics experience to a drink of water amid an ocean of data, Stramer indicated that some crane customers prefer a sip, while others prefer a 20-oz. glass or even a direct hit from the fleet-data fire hose. In the case of Brazil-based specialty contractor Makro Engenharia, it has opted for the fire hose.

“We believe our industry is decades behind” telematics adoption, said David Rodrigues, CEO of the South American crane, rigging and heavy-haul firm. “We want to know where our people are and what they are doing."

Now in its second year of tracking, Makro’s newly formed safety-monitoring division can wirelessly diagnose equipment problems, reduce downtime and improve safety on projects across the vast country. Working with Autotrac, a Brazil-based tech company headed by former Formula One racing driver Nelson Piquet, Makro in the past year has reduced internally reported safety violations to virtually zero from 900, Rodrigues said.

“Link-Belt is doing a good job, but we need to monitor even more because we can’t live on 10 different platforms,” Rodrigues explained, adding that, while working in the remote Amazon region, “you can imagine the cost if we had to have a crane down for a week.” Half of Makro's fleet, or roughly 300 units, is equipped with telematics capability.

Many tech companies have private satellites that offer crane users a wider, global range, but getting all the equipment manufacturers to share the telematics data has been a challenge, Rodrigues observed, as some do not yet provide it to even their clients.

“My belief is that they are trying to keep the data so they can protect themselves,” Rodrigues said. For example, manufacturers may compile information that invalidates a warranty or shields the factory from liability in the event of an accident. Today, telematics offerings are inconsistent among crane makers.

Manitowoc began addressing the emerging telematics demand four years ago with its CraneStar service, developed with OrbComm and now installed on 6,500 units worldwide. All new Manitowoc cranes ship with CraneStar activated for three years for free, and nominal data rates apply thereafter. According to Larry Weyers, Manitowoc’s global executive vice president, 60% of Manitowoc crane buyers have renewed CraneStar after the free trial period expired.

Post a comment to this article

Report Abusive Comment