As the construction industry continues its slow recovery, some industry observers are pointing to a growing disconnect between machines that are sold at retail and machines that are rented. Generally, uncertainty has contractors renting more and buying less. But will they continue to do so after the economy rebounds?

The answer, say some experts, is yes. The recent upswing in equipment rentals provides some clues.

Rental rates and fleet age are two indicators. The increasing demand for short-term equipment acquisition has allowed rental companies to get away with charging contractors higher rental rates on older machines. In its fourth-quarter and full-year results, United Rentals Inc. reported that full-year rental revenue grew 13.2% in 2012, while rental rates tracked upward by 6.9%. It forecasts another uptick, at 4.5%, in rates this year.

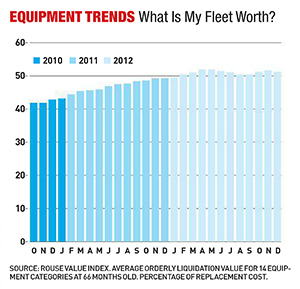

Meanwhile, as rental rates have increased, the age of rental machines has, too. Rental fleets weathered the worst parts of the 2009-10 downturn by letting their machines get older, and fleets reached their high point at about 54 months. Rouse Asset Services, an appraiser that tracks daily fleet trends from the major rental companies, indicates in its February rental report that the average age of machines available to rent has since come down to about 48 months.

This is a notable change from the previous decade, when it was common for rental fleets to dump machines that were much younger, at around 36 months, says Gary McArdle, executive vice president and COO of Rouse.

"We have seen, over the last 10 years, the low side for fleet age was about the mid-30s," said McArdle on a March 12 conference call that J.P. Morgan hosted with investors. "I think what rental companies are realizing is that they can run a little bit more average age." McArdle predicts that, from now on, fleets will settle somewhere between 48 and 52 months.

This trend raises an important question for fleet managers at construction firms as well as the major rental companies: Is renting equipment the new norm? Or is renting a temporary condition until the economy has regained its health?

Ann Duignan, a J.P. Morgan analyst who tracks the machinery sector, suggests in a recent note to investors that the trend of increasing rentals is more than just a reflection of economic cycles.

"It is possible that the data bear out a secular shift away from ownership and toward a rental-centric model," says Duignan.

New data points to an increasing use of rental as an asset-management tool. In the American Rental Association's new rental-penetration index, which was launched last month, the trade association estimates the ratio of equipment rented compared to total construction fleet population was 40% during 2003-11. The number grew to just above 50% during 2010-11. The index will help major rental companies track overall rental growth as they rationalize their investments, says Michael Kneeland, CEO of United Rentals.

Post a comment to this article

Report Abusive Comment