A committee of industry and labor officials, including many in construction, is hopeful a new report from the federal Pension Benefit Guaranty Corp. (PBGC) will prompt Congress to shore up weakening multi-employer pension plans. But pension-reform advocates face a struggle. No bills have been introduced yet in the House or Senate. Reformers' best hope may lie in an expected lame-duck session.

PBGC's fiscal year 2013 projections report, released on June 30, paints a grim picture for its multiemployer-plan program. Without changes, PBGC says it will not have enough funds to support retirees of multiemployer plans that fail. PBGC says its multiemployer program's $8.3-billion 2013 deficit could widen to $49.6 billion, on average, by 2023.

Multiemployer plans are important in construction's unionized sector. In 2013, about 770 such plans covered 3.75 million construction workers and retirees.

Senate Finance Committee Chairman Ron Wyden (R-Ore.) said, "The report confirms what we already know: The multiemployer pension-plan system is in big trouble and putting a significant strain on the PBGC." He said his committee "is taking a hard look at the issues" and pledged to work with other senators on remedies.

House Education and the Workforce Committee Chairman John Kline (R-Minn.) supports the concept of reforming the multiemployer pension system. Kline, with the committee's top Democrat, George Miller (Calif.), and other panel members, said in May, "We continue to work together to find common ground and a responsible legislative solution."

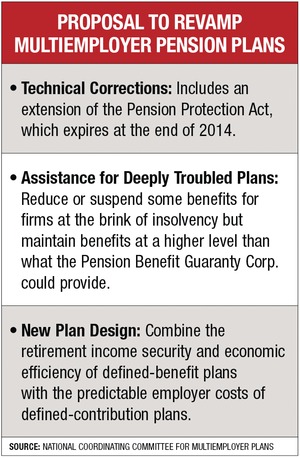

A coalition of 42 organizations, including the Laborers' International Union of North America, the AFL-CIO Building and Construction Trades Dept., Bechtel, the National Electrical Contractors Association and the Associated General Contractors of America, released, in February 2013, a framework aimed at fixing many multiemployer-plan problems. It recommends allowing trustees of troubled multiemployer plans to take limited, early corrective steps, such as suspending some benefits. It also calls for creating hybrid defined-benefit, defined-contribution plans and reducing or eliminating employers' withdrawal liability.

Not all unions support those proposals, says Randy DeFrehn, National Coordinating Committee for Multiemployer Plans executive director and a lead architect of the framework. The machinists' and teamsters' unions, for instance, prefer to see the federal government provide financial aid for troubled plans. But DeFrehn says, "The idea that the government is going to come in on a white horse … and write a check is pretty much a pipe dream."

The 2006 Pension Protection Act expires on Dec. 31. Jim Young, an AGC congressional relations director, says that, in a lame-duck session, pension provisions could be attached to a bill extending expired tax breaks. But Young adds, "Certainly we don't want it just to be an extension of the 2006 law." DeFrehn says the issue is urgent. "We're dealing with real people's benefits here," he says.

Post a comment to this article

Report Abusive Comment