Construction officials' hopes have risen that Congress will repeal what they view as a financially harmful mandate: a requirement that agencies withhold from contractors 3% of each contract's value. The provision, enacted in 2006, is to take effect in January 2013, and industry executives say it would squeeze or even wipe out their profit margins on government projects.

The 3% mandate is “not good for jobs, [and] it's certainly not good for my company,” says Terry Neimeyer, CEO of KCI Technologies Inc., Sparks, Md. Neimeyer, who also is the American Council of Engineering Cos. 2011-2012 chairman, said at a Sept. 14 press conference that the 3% withholding would amount to a $2 million to $3 million “interest-free loan” to the government and prevent KCI from hiring 100 new engineers.

Geoff Burr, Associated Builders & Contractors vice president of federal affairs, says, “I think there's bipartisan support for the fact that this [mandate] is a bad idea and, effectively, a budget gimmick gone awry.” The 3% provision was a revenue raiser, partially offsetting other parts of the 2006 law that included it.

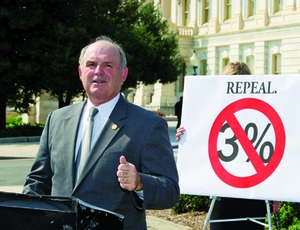

Repeal has strong support in the House. Majority Leader Eric Cantor (R-Va.) said in August the chamber “will move quickly this fall to repeal this burdensome requirement.” Rep. Wally Herger (R-Calif.) has 241 co-sponsors, a House majority, for his repeal bill. It doesn't require offsetting revenue lost by ending the mandate, but the GOP may insist on an offset.

In the Senate, David Vitter (R-La.) introduced a bill identical to Herger's and has 11 co-sponsors. Sen. Scott Brown (R-Mass.) has a repeal bill with an offsetting $39-billion cut in discretionary spending; it has 22 co-sponsors, which is shy of a majority. Lake Coulson, National Electrical Contractors Association executive director for government affairs, says, “The Senate is always challenging, but those numbers are encouraging,”

The mandate, which covers federal, state and local agencies that spend $100 million or more a year on goods and services, initially was to take effect on Jan. 1, 2011, but the 2009 stimulus act delayed it a year. In May, the Internal Revenue Service extended it again, to Jan. 1, 2013. President Obama proposed a further one-year delay in his new jobs bill.

But industry wants to see the mandate removed. “In this economy it's worse than ever to have the 3% withholding go into effect,” says Jeffrey Shoaf, Associated General Contractors senior executive director for government affairs. “We're hearing that people are bidding at cost—or below cost in some cases—just to get work to keep people employed.”

Post a comment to this article

Report Abusive Comment