Nebraska is the latest state to raise its gas tax, with the state Legislature overriding Gov. Pete Ricketts' (R) veto of a bill that adds 6¢ per gallon over the next four years.

Originally approved by Nebraska's unicameral Legislature by a 26-15 vote in early May, the measure increases Nebraska's current 25.6¢-per-gallon gas tax in yearly 1.5¢ increments, beginning on Jan. 1, 2016. Once fully implemented, the increase is expected to generate $76.2 million in additional revenue that will be shared equally by cities, counties and the state Dept. of Roads for road and bridge repairs and help to accelerate the start of several long-term projects.

Nebraska last raised its gas tax in 2008, with a 1.2¢ increase that survived a gubernatorial veto. The state collected $329 million in gas tax revenue in 2014.

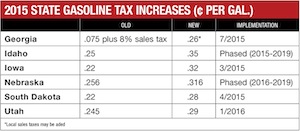

Nebraska is the sixth state to boost its gas tax in 2015, joining Georgia, Idaho, Iowa, South Dakota and Utah.

Proposed gas-tax increases remain alive in three other states. The South Carolina General Assembly is considering a proposal to raise its tax by as much 12¢ per gallon, potentially generating up to $800 million per year for roads. Some legislators prefer applying some or all of a projected $400-million annual state budget surplus to roads in lieu of a gas-tax increase. The Legislature is scheduled for adjournment on June 4.

This week, Louisiana's House of Representatives is debating proposals for a 10¢-per-gallon gas-tax increase and a separate 1¢ sales-tax increase that would provide a dedicated revenue stream of $675 million a year to 12 major statewide highway projects. A third measure would phase out the current annual transfer of as much as $60 million from the state's Transportation Trust Fund to the state police. Louisiana's Legislature is scheduled to adjourn on June 11.

Michigan legislative leaders have proposed a 4¢ increase to the state's tax on diesel and alternative fuels to match the current 19¢-per-gallon gasoline tax. The measure also would index all fuel taxes to inflation. That body will continue to meet through the summer.

One state that won't see a gas-tax increase is Minnesota, where legislators were unable to overcome partisan division over various proposals before adjourning for the year on May 18.

Post a comment to this article

Report Abusive Comment