Wind energy, which accounted for 39% of all new U.S. electric generating capacity last year, could provide 20% of the nation’s electricity by 2030 if growth trends continue for wind power installations, according to a recent study. On the down side, siting, planning and cost allocation issues remain “key barriers” to transmission investment, the study says.

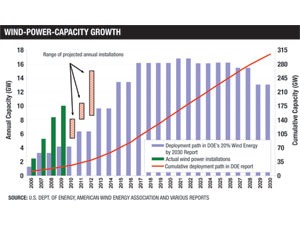

To reach the 20% goal, installations would have to ramp up to 16 gigawatts per year by 2017 and maintain that rate for a decade, states the 88-page 2009 Wind Technologies Market Report, released this month by the U.S. Dept. of Energy.

Wind power additions in 2009 shattered old records, with roughly 10 GW of new capacity added in the U.S. and $21 billion invested. At the end of last year, cumulative wind power capacity in the U.S. stood at more than 35,000 MW, says the study, which was prepared by Lawrence Berkeley National Laboratory, Berkeley, Calif.

But several forecasts suggest that wind power installations this year may range from 5,500 MW to 8,000 MW, a drop of 20% to 45% from the nearly 10,000 MW installed last year, say the report’s primary authors, Ryan Wiser, a Berkeley Lab staff research scientist, and his colleague Mark Bolinger, a research scientist.

Still, an enormous amount of wind power is under consideration. “The federal policy landscape is now more favorable to wind energy than at any other time in the past decade,” states the report, which is available at http://eetd.lbl.gov/ea/ems/re-pubs.html.

At the end of last year, there were some 300 GW of wind power within the transmission interconnection systems administered by independent system operators, regional transmission organizations and utilities, say the authors. The capacity represents about 60% of all electrical power generating capacity within the queues at that time. Most of the wind farms are planned for the Midwest, Northwest, Southwest and Mountain regions, and Texas.

After four years of leading the world in annual wind-power-capacity additions, the U.S. dropped to second place last year, behind China. The U.S. has 26% of the world market; China, with 25,853 MW, has 36%. Germany, with 25,813 MW of capacity, ranks third, says the research.

The news isn’t all good. The authors report the financial crisis, lower wholesale electricity prices and lower demand for renewable energy have taken a toll on the wind power sector. Last year, orders for new turbines slowed and turbine and component manufacturers announced staff reductions.

“With federal incentives extended through 2012, there is less motivation to complete projects” this year, say the authors. But because of a deadline to start construction this year—for developers to qualify for a 30% grant from the U.S. Treasury Dept.—the authors expect many projects to start up this year.

An earlier report by DOE, called the 20% Wind Energy by 2030 Report, which is available at http://www.20percentwind.org/20p.aspx?page=Report, outlines the details of power infrastructure that must be put in place each year for the U.S. to meet DOE�s 20% goal for wind power by 2030. Growth from 2006-2009 and projections through 2012 indicate reaching the goal is possible, but it is not predetermined, say Wiser and Bolinger.

Post a comment to this article

Report Abusive Comment