The switch barely has been flipped on the flow of stimulus-related electricity projects across the nation. Most contractors say that 2010 marks the beginning of a three-year push to construct transmission lines to carry—and smart-grid technology to manage—renewable power.

“What we have seen is a lot of projects out there that are getting into the funnel, and there’s an effort to push them out and get them going,” says Tim Gelbar, president of power and process in the Americas for London-based AMEC.

When the American Recovery and Reinvestment Act was enacted last year, there were very few shovel-ready projects in the electricity sector. The biggest impact ARRA has had is on companies with renewables projects already started. Those companies were able to apply for ARRA grants and use the money received to help finance additional projects.

“Those dollars were paid back to many of our customers for projects, and our customers were able to turn those dollars back around and work on additional programs,” says Jerry Grundtner, vice president of the renewable energy group for Mortenson Construction, Minneapolis. “The stimulus money afforded us additional construction projects.”

For example, more than $500 million in grants to Portland, Ore.-based Iberdrola Renewables Inc. for completed projects is being used by the company to build additional wind farms.

According to the American Wind Energy Association, Washington, D.C., the recovery package spurred construction of wind farms and helped to bring online a record 4,000-plus MW of new wind capacity in 2009. AMEC’s Gelbar says almost every single renewable project currently being built in the U.S. relies on stimulus dollars in the form of grants, tax credits or direct funding.

Grundtner says Mortenson expects 2010 to be on par with 2009 for construction of renewables. To take full advantage of ARRA grants, projects must be under way this year. “We’re seeing a lot of activity. All our customers are fully engaged in trying to get projects built,” he says.

For other ARRA energy programs, such as the smart grid, transmission, and carbon capture and sequestration, many companies were busy in 2009 with the front-end engineering and design work needed for funding applications.

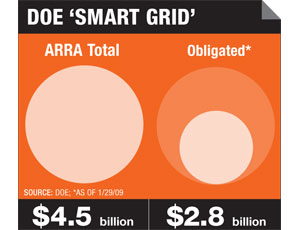

In October, DOE announced the award of $3.4 billion in ARRA smart-grid funds to electric utilities, cooperatives, power authorities, regional grid organizations, local governments and equipment manufacturers. It followed up in November with $620 million in awards for smart-grid pilot projects, including energy storage, “smart” metering, and distribution and monitoring equipment. Much of that money has yet to change hands.

Mortenson Construction

“A lot of work was going on in support of these projects, even though the money wasn’t flowing,” says David Eppinger, vice president for power for Fluor Corp., Irving, Texas. “A lot of money was being spent in anticipation of this year.” Indeed, DOE says the $4 billion in ARRA funds will be supplemented by more than $5.7 billion from the private sector.

Even without direct funding, the stimulus pushed some projects forward. National Grid’s subsidiary in New York announced in January it was moving ahead with a $123-million, smart-grid pilot even though it failed to win DOE funding.

Martin Travers, president of Overland Park, Kan.-based Black & Veatch’s telecommunications division and head of the company’s smart-grid efforts, says many of the projects on the drawing board eventually would have moved forward without stimulus aid, though not as quickly. Now, about $3.4 billion must be spent on the smart grid within three years. “That’s a significant subsidy for our customers,” says Jim O'Neill III, president and chief operating officer for Quanta Services Inc., Houston.

Grundtner adds that there is intense bidding for these jobs. “The renewable market is no different than any other....Everyone is looking for work,” he says.

Grundtner, Travers and others believe if a national renewable-energy standard is approved or other steps are taken to encourage construction of large transmission lines to move renewables, the stimulus energy funds are just the beginning of a boom in energy projects.

It’s critical that the government continues to encourage the development of renewable energy, Gelbar says. Otherwise, “When we really need to get renewable energy, it will be too late.”

Post a comment to this article

Report Abusive Comment