Rising crude-oil and fuel costs will take a toll on highway projects this spring, says Anirban Basu, chief economist at Arlington, Va.-based Associated Builders and Contractors. "The spike in petroleum prices is a major concern," Basu says, adding, "This type of [hike] could become increasingly problematic for both the broader economy and the nation's construction industry."

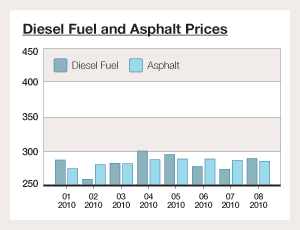

Rising oil prices were reflected in the Bureau of Labor Statistics' producer price index for diesel fuel, which peaked at a year-to-year increase of 50% last July. As of last month, the annual inflation rate for diesel fuel prices has slipped back to 15%.

The producer price index for asphalt paving mixtures has responded slowly but steadily to the higher oil prices. The BLS producer price index for asphalt paving mixtures increased 0.4% last December, followed by a 1.5% increase in January and another 2.3% hike in February. These increases pushed the index 11.2% above February 2011's level.

In producers' earnings reports for last quarter, rising crude-oil prices and transport costs dimmed an otherwise brighter demand picture, says Don James, chief executive officer at Birmingham, Ala.-based Vulcan Materials Co. The gross profit of the company's asphalt business fell to $5 million in the fourth quarter of 2011, down from $8 million in the same period a year ago. That decrease was principally due to the higher input costs of liquid asphalt, says James. "The average sales price for asphalt mix increased more than 9% [over a year ago]," he says.

Cost increases may cause another round of asphalt-price escalation overruns for many state transportation departments this year, which may cut their paving outlays for the season. Nationally, the cost increases particularly affected the Ohio Dept. of Transportation, which faces a $1.6-billion budget shortfall on highway projects this fall. "Inflation has affected our budget and our ability to build and maintain our transportation infrastructure, further tightening our already overstretched budgets," says Jerry Wray, Ohio DOT director.

"We spend approximately 50% more today to get the equal amount of work performed in 2001. In 2011, we estimate our construction program, as well as the cost of steel and concrete, will increase 5.7%, while federal and state motor-fuel taxes are unable to keep up with the rising costs of construction materials," says Wray. Among the 41 states with asphalt-price escalation clauses, overruns totaled about $70 million last year, according to Skokie, Ill.-based Portland Cement Association.

The recent spike in oil prices hits "a wide range of construction materials, and it threatens to put contractors out of business and leave public projects underfunded unless materials can be ordered before prices jump further," says Ken Simonson, chief economist at Washington, D.C.-based Associated General Contractors. "Firms will be forced to pay more for key materials even as demand for construction remains weak."

Post a comment to this article

Report Abusive Comment