In the industrialized world, the U.S. leads the pack with a predicted construction-market growth rate that will average 4% a year through 2025, says a new U.K.-based global forecast. While the U.S. will remain the world's second-largest market, its share will drop in the next 12 years as China builds up its lead to 25% of global output from 18% in 2012.

Global Construction 2025, a market review of 46 countries, predicts total output in that year of $15 trillion, a 70% increase over 2012. Together, China—the world's largest market—the U.S. and India will account for almost 60% of the total.

China's construction sector will grow more moderately, especially after 2020, but it will still average 6% a year, says the report by London researchers Global Construction Perspectives and Oxford Economics.

India's construction sector is set to replace Japan's as the third largest in 2022.

Because "Asian tigers" of the 1990s, such as South Korea, have become industrialized, their construction growth also will moderate. Indonesia, Malaysia, Vietnam and the Philippines are among the new tigers, with markets set to grow by about 5% a year on average.

Russia is set to match these rates, climbing to the sixth-largest market, with similar expansion in Mexico, Chile and Colombia.

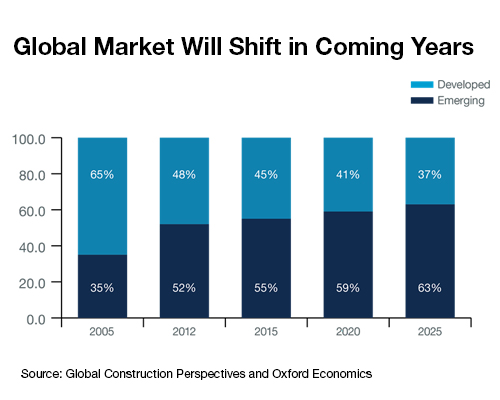

With an average annual growth rate approaching 9%, Nigeria is set to be the world's most expansive major market. The report's authors predict emerging-market construction activity will jump to 63% of the global total in 2025 from 52% now.

Brazil, Latin America's largest market, will lag at 2% average growth. The industrialized world outside North America, such as Japan and western Europe, is also on a slower trajectory.

Despite recovery work following the 2011 tsunami and earthquake and intense fiscal stimulus, Japan's construction sector is expected to virtually flatline for the foreseeable future.

Western Europe also has a lackluster future, according to the forecast, with annual growth rates at under 2%. By 2025, western European demand is expect to fall by 5% below the 2007 peak.

Germany will remain Europe's largest market, although the U.K. could rival it in output if needed infrastructure investment occurs.

The report, produced at undisclosed cost, is sponsored by 24 construction industry firms and other supporting companies.

Post a comment to this article

Report Abusive Comment