The strong economic drivers behind well over $100 billion of planned U.S. petrochemical plants and liquefied-natural-gas export terminals likely will overpower any challenges posed by shortages of skilled craftspeople or specialized equipment.

That is the consensus of experts who are closely tracking what, all agree, is a coming boom in the construction of megaprojects tied to the nation's resurgent oil and gas industry.

The widespread availability of natural gas liquids (NGLs) and, in particular, natural gas and low, relatively stable NGL and gas prices are driving, for the foreseeable future, the biggest increase in planning for new petrochemical, fertilizer and other NGL- and gas-based plants, especially along the Gulf Coast, says Martha Moore, senior director of economics and policy analysis at the American Chemistry Council.

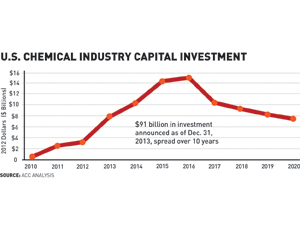

Moore says that, by ACC's latest count, some 136 petrochemical and fertilizer projects are planned, valued at a total of $91.2 billion. Construction likely will peak in 2016-17, she says (see graph).

The sharply increasing availability of low-cost NGLs and gas is giving U.S. chemical companies what Moore calls "a sustainable advantage" over competitors. That long-term edge, she says, suggests that a vast majority of the major projects being planned will advance to financial commitment and construction.

According to an ACC list released in January of chemical industry projects planned for the U.S., "Thanks to growth in shale-gas production, we are seeing a significant increase in capital investment by chemical and other manufacturing industries with the possibility of hundreds of billions [of dollars] in new domestic investments, which will drive new business and job growth."

The report also says, "Already … in the Appalachian region and the Gulf Coast … chemical companies and other manufacturers have announced huge new investments in major facilities."

Among the largest petrochemical projects being planned are new ethane crackers, which break down large molecules of ethane—an NGL—into ethylene, a key ingredient in intermediate products such as polyvinyl chloride, vinyl chloride, ethylene glycol, styrene and polystyrene.

Aither Chemicals is planning a cracker in West Virginia, Sasol is planning one in Louisiana, and Chevron Phillips Chemical, Dow Chemical, ExxonMobil, Formosa Plastics and an Occidental Chemical-Mexichem joint venture are each planning one in Texas.

Just last month, the Occidental-Mexichem JV awarded a $1-billion engineering and construction contract for the cracker to CB&I; construction is scheduled to begin in mid-2014, with a peak construction workforce of 1,700. In October, Chevron Phillips Chemical awarded an engineering-procurement-construction contract for its cracker to a joint venture of JGC (USA) Inc. and Fluor Enterprises.

Post a comment to this article

Report Abusive Comment