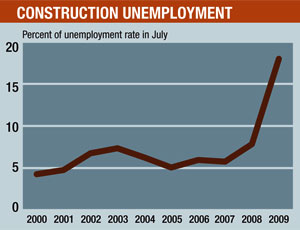

Construction’s stubbornly high unemployment rate bounced upward in July to 18.2%, from 17.4% in June, says the U.S. Labor Dept.’s Bureau of Labor Statistics. The industry’s jobless rate was more than 10 percentage points higher than July 2008’s level.

In its latest monthly employment report, released on Aug. 7, BLS says construction lost another 76,000 jobs in July, adjusted for seasonal variations, compared with average losses of 73,000 during the past three months. The industry has shed more than 1.3 million jobs since the recession began.

BLS’s report also shows the construction’s jobless rate at almost double that of the nation’s overall rate, which stood at 9.4% in July, down slightly from 9.5% in June.

“I don’t see any good news for construction in these figures,” says Ken Simonson, chief economist for the Associated General Contractors, Arlington, Va. Simonson notes that the BLS job-loss numbers for the residential and non-residential construction sectors were “both bad” in July. Residential’s total employment dropped 1.1% from June’s level and 16.4% from the year-earlier level, seasonally adjusted. Non-residential construction’s rate fell 1.3% from the June mark and 13.8% from the July 2008 number.

Simonson adds, “I do expect, going forward, that we will see the residential decline slow or perhaps reverse.” He believes that, by the end of 2009, there will be enough single-family homebuilding and home-improvement work to produce an upturn in the segment. But, he says, “I don’t have much hope for non-residential construction.”

“In the early stages of the residential market downturn, many specialty trades crossed the line into the commercial markets, which is why we did not see a big hit on unemployment earlier,” says Anirban Basu, chief economist with the Associated Builders and Contractors, Arlington, Va. “Once the commercial markets began to participate in the downturn, there was no place to run and no place to hide.” Basu believes the industry is still “many quarters away” from a recovery in the commercial sector.

Simonson expects the heavy and civil construction employment picture to start improving later in 2009 as money from the American Recovery and Reinvestment Act starts to flow into markets such as highways, water and sewer projects. But, he adds, “It was not evident in July.”

Jobs in the heavy and civil sector were down 1.2% for the month and 12.4% from July 2008. Looking at the 12-month trend, construction’s jobless rate climbed from 8% in July 2008 to a peak of 21.4% in February this year. It has seesawed since then, declining in March and April, increasing in May, falling in June and going up again last month. The BLS construction unemployment rates are not adjusted for seasonal fluctuations.

The industry’s lowest unemployment rate during the past five years came in October 2006, when it was 4.5%.

Post a comment to this article

Report Abusive Comment