Driven by a need to speed projects to market, federal agencies are drawing heavily on accelerated delivery methods to move stimulus-funded work into the express lane. More than ever, traditional stand-alone procurement will take a back seat on federal jobs, as many new opportunities end up with firms holding existing “task order” contracts.

The Obama administration’s goal of focusing on shovel-ready work, along with a push for energy-efficiency upgrades at federal facilities, prompted most agencies to draw up long lists of small to medium-sized projects that observers say are primed for design and construction firms that already have indefinite-delivery/indefinite-quantity (IDIQ) contracts.

Fast-Track Procurement

IDIQ is a procurement method allowed under the Federal Acquisition Regulation for a range of architecture, engineering and contracting services on federal projects. Unlike a stand-alone contract for a single project, an IDIQ approach allows the contract holder to perform several specific services for an agency within the term limits of the contract. Parameters within a contract include a specific contract period, a limit on the total value of work that can be awarded within that time frame, and the location where the tasks can be performed.

Successful IDIQ contractors then compete against other contract holders for task orders. Agencies often use these contracts for easily defined, low-risk projects that need to mobilize quickly because contract holders are essentially pre-approved to execute the task. “We see IDIQ being the contract vehicle of choice for most work,” said Doug Hyde, vice president of Jacobs Global Buildings North America, Arlington, Va. “Our expectation is everything will be competed, but mostly through use of sizable IDIQs to give agencies flexibility in how they reach out to the private sector.”

The U.S. General Services Administration, which is dedicating most of its $5.5 billion in stimulus funding to modernization projects, is set to draw heavily from its existing cadre of companies under contract. “We’ll be reaching out to our IDIQ contractors more than normal in terms of the volume of work and the size of contracts we’ll let,” says Bill Guerin, head of the GSA’s new Recovery Act Program Management Office.

The U.S. Dept. of Defense, already pressured to keep pace with base-realignment and closure projects, is also likely to use more of its existing IDIQs and multiple-award task-order contracts. Among the nearly 3,000 DOD stimulus projects, $2.3 billion in work will be let under the military construction program, with most expected to be contracts of less than $10 million. Another $3.4 billion is dedicated to facility sustainment, restoration and modernization, with many of those projects valued at under $1 million each.

J. Joseph Tyler, director of military programs at the Army Corps of Engineers, says task order procurement is ideal for much of the stimulus-funded work, balancing the need to mobilize contractors quickly while fostering competition.

“Congress wants competitive projects, and our multiple-award task-order contracts fit that really well,” he says. “We establish those contracts and competitively bid them. Then individual task orders are competed, so we compete twice.” Tyler says this fits Office of Management and Budget (OMB) guidance for competition “and meets our goals.”

Anticompetitive?

Agencies are already leaning heavily on IDIQ contracts. Data from the Federal Procurement Data System show that orders through contracts grew from 14% of total dollars in fiscal 1990 to about 52% in fiscal 2005, says OMB.

Increased reliance on IDIQ capacity has raised concerns among critics who argue that the process limits competition. In a May 2007 memo to federal acquisition officers, then-OMB Administrator Paul Denett warned of “a lack of meaningful competition for orders” in light of the increased use of IDIQ vehicles.

As more tasks go to IDIQ holders, some small to medium-size firms who don’t have IDIQ contracts are locked out, says Michael Payne, chairman of the federal construction practice group in Cohen Seglias Pallas Greenhall & Furman, a Philadelphia law firm. Although IDIQ contracts are bid in open competition, he says the terms can be limiting.

With IDIQ contract limits now reaching into the hundreds of millions of dollars and the scope sometimes spanning multiple states, many firms can’t get adequate bonding to compete, Payne says. He contends the method could hurt many of those the stimulus is designed to help. “The purpose is to lead to job creation,” he says. “What better way than to go with open competition and make it available to the maximum number of companies?”

Even many large firms see limited opportunities with IDIQ work. Mike Crase, senior manager of the federal services group at Providence, R.I.-based Gilbane Building Co., says the contractor will pursue many large projects that are expected to be let as stand-alone procurements, but it won’t see significant IDIQ work. “There are going to be a lot more opportunities for the firms typically in the pools of IDIQs,” he says. “We’re just not in a lot of those pools.”

Full Speed Ahead

But many agencies vow that more opportunities lie ahead. The stimulus law is providing some with unprecedented levels of funding, pushing existing IDIQ capacity to the limit. The U.S. Forest Service received nearly $650 million in stimulus funds for construction, more than double its fiscal 2009 budget, but lacks sufficient capacity to use IDIQ for all funded projects, according to Joseph Walsh, an agency spokesman. As a result, it will look to procure new contracts, including new IDIQs.

DOD is also expected to expand IDIQ capacity. Although the Corps’ Tyler says the agency won’t have capacity issues in 2009, he expects it will need to increase IDIQ use heading into 2010.

According to Joseph Gott, chief engineer and director for capital improvements at the U.S. Navy’s Naval Facilities Engineering Command, the service is adding new IDIQ-type contracts, including a $900-million global multi-award contract that was advertised this spring. But it won’t increase the capacity of existing contracts, he says. “The problem is, if we expand someone’s existing contract, people will argue that they get to compete on it,” says Gott.

Advertising new IDIQs is welcome news for private-sector contractors looking to get a piece of the federal market for the first time. Marco Giamberardino, senior director of the Associated General Contractors’ federal and heavy construction division, says contractors looking at the federal market already face considerable barriers.

Factors such as a past-performance record can weigh heavily on bid proposals. “Multiple-award contracts help contractors that know the market really well, but if you’re only using existing contracts, it’s not providing new prime contracting opportunities for new people,” he says.

But increased use of IDIQ may not be just a temporary solution for stimulus project procurement. “IDIQ contracting is here to stay,” Hyde says. “It gives clients a lot of flexibility. For the work that is small or less complex, it makes sense.”

Agency Choice

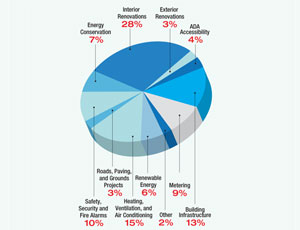

Federal agencies are nonetheless not universally embracing IDIQs to handle stimulus work. The Dept. of Veterans Affairs will award nearly 1,000 projects, valued at nearly $1.1 billion, using primarily non-recurring maintenance contracts (see pie chart).

Not many of its stimulus projects lend themselves to IDIQ contracting, according to a department spokesperson. Specific contracting strategies are being left to individual agency medical centers, based on their own needs and existing capacity.

At the National Park Service, IDIQ use will be extensive for architecture and engineering work, but the method will be limited for construction contracts.

The agency’s Denver Service Center, which will award nearly $500 million in stimulus projects, will draw from its existing IDIQ capacity for design-related tasks to ease impact on limited in-house staff, says Sam Whittington, center director.

IDIQ is not a good procurement match for the agency’s construction demands given the geographic diversity of its facilities, he points out. “IDIQ for construction works OK if you have a concentrated amount of work in a small area,” Whittington says. “We’re so spread out across the country, and many of the individual projects are so small.”

Post a comment to this article

Report Abusive Comment