Steven Golia, a leading promoter of controversial individual surety bonds, no longer works for national insurance-surety broker Arthur J. Gallagher & Co., the company confirms.

Golia had become an employee in January after Gallagher acquired McIntyre Risk Management, a Cherry Hill, N.J. broker for whom he had apparently worked since late last year.

Now based in Haddonfield, N.J., Golia had announced in an email newsletter after the acquisition that the new parent would be managing general agent for individual surety bonds from surety Edmund C. Scarborough, whose previous bonds had been backed with coal waste.

Gallagher and Golia several days later retracted the announcement.

Gallagher has had a substantial contract surety practice and its executives are active in the National Association of Surety Bond Producers, which has battled fraud in individual surety for many years. In 2007, NASBP settled a lawsuit against it by Scarborough.

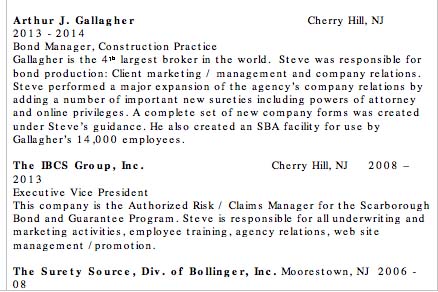

Golia, in a resume posted online, says he served as executive vice president of Scarborough's IBCS Group, Inc. from 2008 to 2013. In that and other roles at IBCS, Golia has signed as the power-of-attorney on Scarborough bond forms.

Golia declined to comment to ENR.

Linda Collins, a Gallagher communications vice president, would not discuss any of the details behind Golia’s departure.

Acquisition Spree

Golia joined the future Gallagher unit after the company had finished a yearlong acquisition spree, with one of its last deals being the purchase of McIntyre Risk Management.

Surety executives of Itasca, Ill.-based Gallagher were apparently stunned when they discovered that Gallagher employed Golia via the McIntyre acquisition.

Small contractors buy individual surety bonds from private parties, rather than from corporate or U.S. Treasury Dept.-listed sureties. Corporate sureties generally are insurance companies with substantial assets.

Although individual sureties provide credit to small contractors that may be unable to qualify for corporate surety, the assets backing the bonds are hard to verify and fraud is rampant.

Golia seemed to indicate he would continue his individual surety work with IBCS from his new platform at Gallagher.

On Jan. 30, Golia sent out a newsletter announcing that Gallagher McIntyre, the new unit, “is now the MGA,” or managing general agent, for IBCS.

Since the recent parting with Gallagher, Golia, seems to have moved on.

He has created a website for a new company, Golia & Associates, LLC, Surety Consultants, where his updated work experience is attached. It lists his several months of service to Gallagher as a productive period. During that time as “bond manager, construction practice,” Golia claims he “performed a major expansion of the agency’s company relations by adding a number of important new sureties including powers of attorney and online privileges.”

Post a comment to this article

Report Abusive Comment