Contractors on the West Coast may be scratching their heads, asking why lumber prices are rising when they are falling every where else. The answer is China. The Chinese have more than doubled their purchases of lumber from Canada and the U.S. within the last year, according to industry specialist Random Lengths, Eugene, Ore. That demand drives a price disparity in the Pacific Northwest, especially for spruce products, and prices in the rest of the country.

“Between 2000 and 2009, western spruce 2 X 4 prices averaged about 12% less than our national composite price,” says Robert Berg, an economist with the Bedford, Mass.-based forecasting firm RISI. “It’s now selling at parity to the composite price, which is a 12% premium, and that strength is really tied to the Chinese market.”

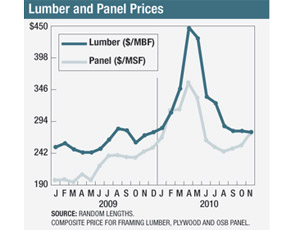

Nationwide, RISI’s composite price fell from a peak of $357 per thousand board ft last April to $263 this month. Berg predicts prices will end 2011 at about where they are now.

Prices for lumber and logs from the western United States and Canada have jumped more than 25% since July of this year due to Chinese presence in the market, says Random Lengths.

“We have had domestic builders and industrial users cancel and postpone projects because of the sharp increases in lumber costs since July,” an executive with a large U.S. lumber distributor said. “Prices could increase another 8 % to 10% within the next few months—who knows? People don’t realize how much product is leaving the continent.”

China’s North American purchases have focused on lower grades of lumber, which are destined for use in concrete forms for high-rise construction. But recent purchasing trends have seen more higher-grade lumber included in the mix, says Random Lengths. Logs are destined for China’s domestic mills to supply the country’s enormous market for composites, plywood and veneers as well as lumber.

The seeds for the unexpected rise in western lumber and logs were sown in 2007 when Russia imposed an export tax on logs. The tax started at 6.5% but quickly increased to 25% by mid-2008. Chinese buyers of wood fiber then turned to North American forest products, made doubly attractive by low prices and a weak dollar. China’s impact on North American prices is further amplified by the recession, which drove production cuts at West Coast mills.

China’s potential fiber-supply gap (the difference between total demand and total domestic supply) is projected to reach approximately 150 million cubic meters by 2015, according to a report by International Wood Markets Group of Vancouver, B.C. That volume is more than the entire Canadian timber harvest in 2009—a strong indication that China’s wood imports must continue to rise in the short- to medium-term period to match with projected consumption.

“China is expected to be the fastest-growing lumber producer, importer and consumer nation in the world over the next half-decade,” says Gerry Van Leeuwen, vice president of International Wood Markets Group. He forecasts an average annual increase in Chinese lumber consumption of more than three billion board ft per year and says that meeting the needs of its growing middle class will require huge raw material imports over the next five years. This fast-paced consumption growth is expected to have a significant impact on global wood demand, especially as the major global economies begin to emerge from the current recession.

A key question is whether higher North American lumber prices could cause Chinese buyers to scale back their purchases from U.S. and Canadian mills. This does not appear to be the case, according Random Lengths. Concerns that the Chinese would pull back when mill prices for West Coast hemlock hit $260 per thousand board ft several weeks ago were overcome when the price blew through that level due to new orders from China.

Russia now is now considering dropping the log export tax as that country moves toward meeting World Trade Organization membership requirements. Thanks to China’s soaring demand, the impact of that move would probably not be felt until 2012, with little downward price movement expected.

Prices for eastern U.S. pine may be starting to feel the effects of Chinese buying as prices for western Ponderosa Pine have risen.

Trucks and containers in western ports are also in short supply to move Chinese purchases from the producers to the ports. This has led to an increase of $10 per thousand board feet for lumber deliveries from the northwest to California.

Post a comment to this article

Report Abusive Comment