The recession wasn’t supposed to last this long nor be this deep. Federal stimulus spending was meant to return us to prosperity as opposed to just diverting financial disaster. But taking a few steps back from the precipice may be the best our stimulus money could buy. The trillion-dollar construction market of a few years ago now appears to have been an illusion, and an $800-billion annual market may be the new reality. In the pop of a bubble, a fifth of the construction market may have evaporated, leaving the industry to make drastic adjustments.

The market already has squeezed about all it can from labor costs, materials prices and subcontractor margins. But with the housing rebound fizzling and the non-residential building market recession deepening, there appears nowhere for costs to go—neither up nor down.

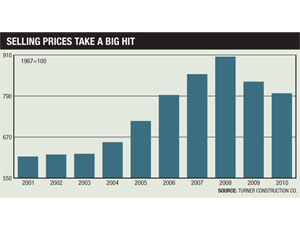

In this environment, the construction industry selling cost and general-purpose indexes are starting to converge. The selling cost indexes, which, in part, reflect shrinking subcontractor margins due to competition, are starting to see year-to-year changes flatten out after a series of steep double-digit declines. For example, The Turner Construction Co.’s selling price index showed no change this quarter and is down just 2.7% from a year ago. A quarter ago, the Turner index posted an annual decline of 7.9%, while in the third quarter of 2009 it showed a year-to-year decline of 10.8%.

General-purpose building-cost indexes, which only measure labor and materials prices, are starting to ease back. For example, the LSI index compiled by the Sierra West Group, Sacramento, Calif., was down 2.6% from a year ago this quarter. By comparison, three months earlier, it posted an annual increase of 1.1%; a year ago it showed an annual inflation rate of 2.4%. The two series of indexes appear to be converging into the plus- and minus-2% range—not a wide spread by recent standards—indicating costs are indeed bottoming out.

If the Federal Reserve Board’s inflation target was 2%, then it surpassed expectations in construction.

“We are seeing a very slight uptick in price inflation, but by the time it filters through to bid prices, it is all squeezed out,” says Julian Anderson, principal with Rider Levett Bucknall Ltd, Phoenix. The RLB selling-price index inched up 0.3% this quarter but remains 0.5% below a year ago.

“At the beginning of the downturn in the non-residential building market, we saw some large cost savings,” says Karl Almstead, vice president of Turner Construction Co., New York City, who is responsible for putting together that firm’s selling-price index.

As the volume of work dropped, the remaining workforce used more experienced workers, giving productivity a boost and lowering labor costs. At the same time, many subcontractors were slashing margins to win work, says Almstead. “We already have squeezed labor down as far as it is going to go, and the same holds for profit margins,” Almstead says. “There are really not a whole lot of options to go much lower and stay alive. … We are headed into a new reality and need to think about what a recovery will look like.

“We can’t return to unsustainable bubbles,” Almstead adds. He thinks a second round of stimulus spending may be needed to help remove uncertainty from the markets until the industry “gets comfortable with where it is,” he says.

Several materials prices that initially rebounded along with the housing market earlier this year are starting to bottom out again as the housing recovery falters. “The upturn in housing was more a reflection of the homebuyers tax credit and was not an indication of market strength,” says Robert Martin, construction materials analyst for IHS Global Insight, Washington, D.C. “Lumber prices got a little ahead of themselves, and we see a correction in the next six months, with prices returning to where they were at the beginning of the year,” he says.

Cement prices have been falling for about 10 months and are nearing the bottom, says Martin. “But given the weakness of the non-residential building market, we don’t see cement prices making significant gains until one or two years down the road.” He predicts that, by the fourth quarter of 2013, cement prices will still be 1.8% below their 2009 peak.

“Steel is grossly overpriced,” says John Anton, Global Insight’s steel analyst. By 2011’s first quarter, he expects rebar prices to fall 12.6% from the second quarter of this year. In the same period, he sees an 11.2% drop in structural-steel prices.

Post a comment to this article

Report Abusive Comment