Cement prices could increase substantially within the next few years because of new regulations from the federal Environmental Proection Agency as well as the state of California’s regulations requiring substantial reductions in CO2 and hazardous air-pollution emissions from domestic cement plants.

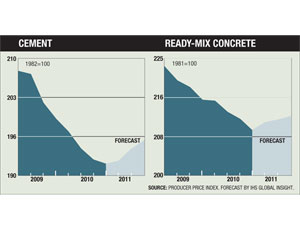

For now, the prolonged recession in the non-residential building markets continues to roll back prices. In July, the producers price index for cement fell another 1%, capping nearly a year of monthly declines, according to the Bureau of Labor Statistics. The PPI for cement is currently 5.3% below the level of a year ago.

However, prices may have bottomed out. The Washington, D.C.-based forecasting firm IHS Global Insight predicts cement prices will begin to slowly increase by the first quarter of next year, ending 2011 with a 2% annual gain.

Cement production costs are projected to increase nationwide at least $15 per ton by 2020, according to data released by the Portland Cement Association, Skokie, Ill. The increase is linked to the costs of compliance with new rules issued by the EPA on Sept. 9, 2010.

These rules mandate drastic cutbacks in the emissions of mercury, total hydrocarbons, hydrochloric acid and particulate matter by 2013. The new EPA rules “will cost domestic cement producers at least $3.4 billion to comply with the mandated reductions, and not all plants will be able to meet the standards by the 2013 deadline, meaning they will have to shut down operations,” says Andrew O’Hare, vice president of regulatory affairs for the PCA. “We estimate as many as 18 U.S. cement plants could be forced to close in the next three years.”

One plant that could face closure—even though more than $20 million has been spent in upgrades to reduce mercury emissions—is Ash Grove Cement Co.’s Durkee, Ore., facility. The Durkee plant uses limestone from a nearby quarry that is extremely high in mercury content. Ash Grove and the Oregon Dept. of Environmental Quality entered into an agreement in 2008 that stipulated the Durkee facility would put in place by July 17, 2010, technology to effect an 85% reduction in the plant’s average of 2,000 tons per year of mercury emissions. Ash Grove met the deadline. Less than a month later, EPA released a draft of its new rules, which called for further reductions in mercury emissions—reductions that Ash Grove officials contend may be impossible to meet.

O’Hare points out that U.S. cement prices could ratchet upward if multinational cement producers decide not to invest in new construction or upgrade existing U.S. cement plants. “PCA’s predictions are for a 30% increase in U.S. cement consumption by 2020. If domestic production is down and we have to compete with growing foreign markets for cement, the result could be even higher prices to U.S. consumers,” he says.

PCA’s projected production cost increase does not include potential additional costs of compliance for California- based cement plants, which are subject to that state’s Global Warming Solutions Act. The measure calls for reducing CO2 emissions from California cement producers. Shifting production offshore—to plants in China and other countries where cement producers are exempt from U.S. environmental standards—is called “leakage” and failure to account for leakage in projected cost impacts is one of the major complaints U.S. producers have against the new regulations.

“Imported cement should have to meet the same environmental performance standards in its production as U.S. producers or [be subject to] an import tax,” says John Bloom, chairman of the Coalition for Sustainable Cement Manufacturing and Environment.

“One thing we recognize is that this situation is not entirely the fault of the EPA,” says O’Hare. “The fact is, they are mandated by law to give no more than three years to comply with their regulations,” he says. “It is counterproductive to our common goal of reducing environmental contamination if all we do is shift the sources of contamination to foreign countries because domestic producers close plants,” O’Hare adds.

Post a comment to this article

Report Abusive Comment