The industry is in the midst of its worst recession in a generation, and most major firms worry the market will not come out of its slump any time soon. However, the latest ENR Construction Industry Confidence Index shows industry leaders are beginning to see some light at the end of the tunnel.

The ENR Construction Industry Confidence Index was launched in April, when the market looked its bleakest. At that time, executives from 752 large contractors, design firms, specialty firms and subcontractors, and construction-management firms saw little about which to be optimistic. Their views seem to be changing, however slightly.

In the initial survey, 86% found the overall market declining. Few predicted a turnaround within the next three to six months, and only 28% believed the market would be improving in 12 to 18 months. Based on responses that the market was improving or stable at that time, in three to six months, or in 12 to 18 months, ENR assigned an initial index rating of 25 on a scale of 100 for the industry’s level of confidence in the market. An index rating of 50 would represent a neutral market.

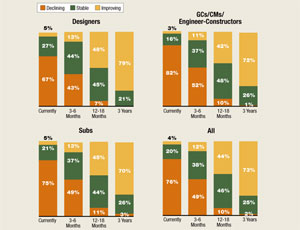

For the current CICI, 778 firms responded during the period from June 22-July 1. Of those responding, 76% found the current overall construction market declining, compared to 86% in April. Another 49% believed the market would continue to decline during the period three to six months from now, compared to 55% in April. For those looking 12 to 18 months ahead, 44% predicted the market would be improving, compared to only 28% in the previous survey. As a result, ENR’s CICI index rating rose to 30, up 5 points from the previous quarter.

This gradual softening of attitudes from the ENR CICI survey parallels the findings of the most recent CONFINDEX, released on July 8 by the Construction Financial Management Association, Princeton, N.J. “We poll 200 chief financial officers of general contractors, subcontractors and heavy and civil contractors among our membership,” says James Bartsch, CFMA’s director of research and analysis. “We try to measure the market’s health based on several objective criteria, including current and future business conditions, bank credit availability, bonding credit availability, line of credit status and backlog.”

CFMA’s current CONFINDEX rating is 89 on a scale of 200, up from 84 in its previous index, released in March. For the CONFINDEX, a rating of 100 is considered a neutral market. “Even though we are still in negative territory, the gradual rise in our index is showing that our members have a sense of optimism,” says Peter Schwartz, CFMA’s CEO. He says CFOs responding to the CFMA survey are beginning to believe the turnaround will begin in 2010, and conditions will begin to improve, particularly in improving backlog, by the second half of 2010.

Vertical Markets Flat

In addition to the overall market, ENR’s CICI survey also asked firms to assess their own particular market sectors. Not surprisingly, firms in the buildings markets are less optimistic than others. Applying the ENR CICI index formula to specific sectors, infrastructure came out the highest rated. Within that bracket, the power market is highest overall, rating a 59 out of 100. Transportation and water, sewer and wastewater markets rated a 57 and 56, respectively. Other markets in positive territory are petroleum, at 52, hazardous waste, at 51, and health care—the only positive building market—at 53. K-12 and higher education markets both came in at 49.

The most pessimistic markets are retail, at 17, commercial office, at 19, distribution and warehouses, at 22, hospitality and entertainment & cultural, both at 23, and multi-unit residential, at 25. All are below the overall construction CICI rating of 30. The industrial and manufacturing market came in at 30 on the CICI scale.

| Market | No. of Firms | Currently (%) | 3-6 Months (%) | 12-18 Months (%) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dec- lining Activity | Stable Activity | Impro- ving Activity | Dec- lining Activity | Stable Activity | Impro- ving Activity | Dec- lining Activity | Stable Activity | Impro- ving Activity | ||

| Commercial Office | 543 | 91 | 8 | 1 | 71 | 24 | 5 | 17 | 52 | 30 |

| Distribution/ Warehouse | 267 | 84 | 15 | 0 | 61 | 35 | 5 | 19 | 53 | 28 |

| Education K-12 | 409 | 31 | 58 | 11 | 21 | 56 | 24 | 8 | 48 | 45 |

| Entertainment | 173 | 82 | 16 | 2 | 60 | 35 | 5 | 20 | 50 | 30 |

| Health Care | 456 | 31 | 58 | 11 | 15 | 56 | 29 | 2 | 38 | 59 |

| Higher Education | 459 | 36 | 54 | 11 | 20 | 55 | 25 | 5 | 46 | 49 |

| Hotels | 325 | 80 | 18 | 2 | 62 | 32 | 6 | 20 | 56 | 25 |

| Multi-Unit Residential | 293 | 80 | 15 | 4 | 57 | 34 | 9 | 21 | 42 | 36 |

| Retail | 387 | 92 | 7 | 1 | 73 | 23 | 4 | 25 | 47 | 28 |

| Industrial/ Manufacturing | 334 | 74 | 24 | 2 | 44 | 45 | 11 | 13 | 45 | 42 |

| Transportation | 226 | 28 | 53 | 20 | 16 | 44 | 40 | 7 | 35 | 58 |

| Water, Sewer and Waste | 229 | 23 | 61 | 16 | 14 | 50 | 36 | 4 | 45 | 52 |

| Power | 171 | 28 | 49 | 23 | 11 | 45 | 44 | 6 | 30 | 63 |

| Petroleum | 100 | 39 | 48 | 13 | 15 | 54 | 31 | 7 | 30 | 63 |

| Environmental/ Hazardous Waste | 87 | 35 | 51 | 23 | 15 | 59 | 14 | 7 | 41 | 52 |

| SOURCE: ENR | ||||||||||

Pessimism in the building sector is not necessarily reflected in the interest in green buildings. ENR asked its CICI survey respondents whether they believed the downturn was hurting interest in green and sustainable building. While 156 (20%) firms believed the bad economy does mean owners are showing less interest in green building, 133 (17%) firms believe interest in sustainability was actually on the rise despite tough economic times.

ENR also asked CICI survey respondents whether they believe the American Recovery and Reinvestment Act is having a positive impact on the construction industry and their own firms. Only 3% of the respondents strongly agreed the stimulus package was having a positive impact on the industry, while only 28% generally agreed it was a positive for the industry. On the other hand, 43% of those surveyed disagreed that the American Recovery and Reinvestment Act was having a positive impact on the industry, including 16% who strongly disagreed.

Asked about ARRA’s direct impact, only 2% strongly agreed it would benefit their firm, while 14% generally agreed their firms would benefit from ARRA. Surprisingly, 110 of the 777 firms responding to this question said they had gained work under the federal stimulus package.

Most firms agree the construction market is down and should remain in recession through next year. But more firms than before believe the hard times will not continue indefinitely, and the trick now is to hold on and be smart until the recovery. As one engineering exec says, “This tough business climate won’t last, but tough business leaders and their firms will.”

Post a comment to this article

Report Abusive Comment