Along-awaited economic stimulus bill continues to advance on Capitol Hill as Democrats push to meet their goal of having a final measure on President Barack Obama’s desk by about Feb. 16. But Senate Republicans continue to criticize the packages as being too big and contend that not enough of the money will turn into programs or projects that create jobs in the next year to two years. Still, the GOP may not have the votes to derail the packages.

Todd Hauptli, American Association of Airport Executives’ senior executive vice president, thinks the bills will clear the House and Senate and negotiators from the two chambers will work out differences over the next couple of weeks. Lawmakers’ progress has been frustratingly slow to state and construction industry officials anxiously seeking relief from the recession. But Hauptli says, “They’re still moving at lightning speed by legislative standards.”

The House is further along, with floor debate beginning Jan. 27 on its version of the package. The Senate is playing catch-up but now is picking up the pace. That chamber’s Appropriations Committee cleared its portion of the package on Jan. 27, and the Finance Committee was working on the tax title.

The House and Senate packages are the same size: each totals $825 billion, with $550 billion in spending and $275 billion worth of tax cuts. The two versions also focus on the same main categories, including infrastructure, energy and direct aid to states. But there are differences in how much each allocates to specific programs.

Appropriations’ new chairman, Daniel Inouye (D-Hawaii), who led the drafting of the $365.6-billion discretionary-spending portion, says, “The funding provided here is targeted. It would address short-term needs and is intended to be expended quickly.”

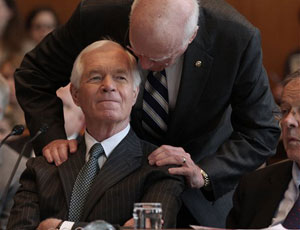

But most Republicans are skeptical. Appropriations’ top GOP member, Thad Cochran (Miss.), voted to move the bill to the floor but not without reservations. “We are effectively being asked to take a leap of faith that this massive amount of spending will stimulate a suffering economy despite evidence that much of the funding will not be spent in the next year or two,” he says.

Some GOP appropriators contend the bill is moving too fast and want more time to see whether it will revive the economy. “This looks like fire, ready, aim,” says Sam Brownback (R-Kan.).

Through all the debate so far, construction funding remains a significant element in the House and Senate packages. By ENR’s estimate, each bill provides about $160 billion in construction-related spending or loan guarantees. Some programs, such as school construction aid and Dept. of Energy “smart grid” spending, would receive the same amount, or nearly the same, under each plan.

But there are wide differences in allocations for other budget accounts. For example, the Senate has $1 billion for prison construction and upgrades; the House has zero. The Senate also allots $5.5 billion for cleaning up DOE’s former nuclear-weapons facilities, while the House has $500 million.

On the other hand, the House is more generous to Clean Water state revolving funds, providing $6 billion, compared with the Senate’s $4 billion. The House also recommends $3 billion for Airport Improvement Program construction grants; the Senate version contains $1.1 billion.

The largest single construction spending allocation in each bill is federal highway funding. Senate appropriators provided $27.1 billion. Of that, about $570 million is set aside for projects on American Indian reservations, federal lands and for ferry transportation. The other $26.5 billion would be distributed to states according to the current formula for the Surface Transportation Program. STP requires 10% of the funding go for safety-related spending and another 10% for bike paths and other transportation “enhancements.”

The Senate’s $26.5-billion highway sum is lower than the House bill’s $29.3 billion. But Senate appropriators also included a new wide-ranging discretionary surface transportation grant program totaling $5.5 billion. Highways would probably get some of that money, but transit, passenger and freight rail, seaport and multimodal projects also would be eligible. As envisioned, the U.S. secretary of transportation would decide which projects are funded through the new program. But one source says, “I will be surprised if that survives” in the final version of the legislation because it is too cumbersome. He says the idea behind the stimulus is “getting the money out the door fast.”

Engineering and construction groups also have zeroed in on a provision in both bills that deal with a looming new requirement: a mandate that federal and nonfederal public agencies withhold 3% of the value of all contracts. A 2005 tax statute mandated the 3% withholding, saying it would take effect in 2011. Industry groups, which have been fighting the requirement for the past several years, prefer the language in the House stimulus bill, which would repeal the 3% withholding outright. The Senate finance version only would delay the effective date for one year.

| Total Construction-Related Spending (est.) | House $159 Billion | Senate $160 Billion |

|---|---|---|

| House Proposal | Senate Proposal | |

| TRANSPORTATION | $43.8 billion | $45.9 billion |

| Includes federal-aid highways | $30 billion | $27.1 billion* |

| ENERGY | $36 billion | $32.7 billion |

| Includes “smart grid” investment | $4.5 billion | $4.5 billion |

| HOUSING/HUD | $13.3 billion | $11.4 billion |

| Includes public housing repair, construction | $5 billion | $5 billion |

| DEFENSE/VETERANS | $11.5 billion | $12.9 billion |

| Includes VA medical facility work | $950 million | $3.7 billion |

| SCHOOLS | $20.1 billion | $19.5 billion |

| Includes K-12 renovation, repair | $14 billion | $16 billion |

| HEALTH AND HUMAN SERVICES BUILDINGS | $4.1 billion | $2 billion |

| Includes community health centers modernization | $1 billion | $1 billion |

| OTHER BUILDINGS | $12.9 billion | $14.3 billion |

| Includes GSA energy-efficiency upgrades | $6 billion | $6 billion |

| WATER AND ENVIRONMENT | $17.1 billion | $21 billion |

| Includes EPA Clean Water state revolving fund | $6 billion | $4 billion |

| OTHER | $575 million | $285 million |

| Includes Bureau of Land Management, infrastructure, buildings maintenance | $325 million | $135 million |

NOTES: NUMBERS ARE ROUNDED. SOME CATEGORIES PROVIDE FUNDING FOR CONSTRUCTION AND NONCONSTRUCTIONCAPITAL SPENDING; *SENATE BILL HAS FLEXIBLE FUNDING CATEGORY, WHICH IS EXPECTED TO INCLUDE SOME HIGHWAYPROJECTS. SOURCES: HOUSE, SENATE APPROPRIATIONS COMMITTEES, ENR | ||

“We’re hoping the Senate will take the next logical step and agree with the House on the full repeal of 3%,” says Steve Hall, American Council of Engineering Companies’ vice president for government affairs. Getting the Senate to agree is “going to be a challenge,” Hall says. But he notes that the Senate Finance Committee’s stimulus bill marks the first time that panel has supported even a delay in the withholding. “Perhaps there’s recognition that there are problems and concerns out there over this,” he says.

Among the Finance Committee’s $275 billion in tax incentives are several that construction is watching. Probably the most important is a provision allowing companies to “carry back” current losses to offset taxable income from as far back as five years ago, says Ken Simonson, the Associated General Contractors’ chief economist. Under current law, such losses can be carried back only two years. Simonson says the proposed change would help improve cash flow for many construction and equipment-supply companies that were profitable in recent years but now are posting losses.

The House and Senate tax provisions also include a one-year extension of the Section 179 break, which permits small businesses to deduct from their income the costs of certain capital goods in the year those items are bought. Both bills also contain a one-year extension of a bonus-depreciation incentive that was in effect for 2008. Those provisions “would lower the cost of construction,” Simonson says. Other tax incentives for sectors such as wind-energy and other alterative-energy projects “would add to the demand for construction,” he adds.

Nick Yaksich, the Association of Equipment Manufacturers’ vice president for global public policy, says the Section 179 and bonus depreciation provide important assistance in keeping equipment purchasers’ economic and investment options open. But Yaksich notes that the equipment market has dropped dramatically.

“We need demand for product, and that’s why the funding part [of the stimulus] is so critical,” he says. Does AEM prefer the House or Senate bill? “Our preference is the highest number as soon as possible,” he says. “The pump needs to be primed now.”

Post a comment to this article

Report Abusive Comment