Owners of projects in the education sector this year are faced with conflicting market conditions. On the one hand, the market promises robust new rounds of construction due to record-breaking student populations, but on the other hand, the market threatens to delay or kill projects and programs that seemed economically feasible just a few months ago due to the meltdown in the financial sector and declining revenue for states, municipalities and universities.

Owners face a growing need for new K-12 and higher education facilities in nearly every community in the nation. School districts, colleges and universities need new construction to keep up with evolving technology and changing student demographics. To attract students and maintain profit margins in what is a highly competitive buyers’ market, owners are asking architects for innovation, contractors for speed and both for sustainable construction approaches.

For all the promise in the market, however, there are plenty of owners for whom project financing uncertainties have swept aside all other concerns for the moment as they modify programs and projects to meet the shrinking funding stream. Much to the chagrin of designers and constructors, the global financial crisis has school districts in every state scaling back once-robust construction programs.

The State of Maine this fall announced delays to 12 major school-construction projects totaling $348 million in 11 school districts after bonds rates became prohibitive. In Cumberland County, N.C., school officials reversed plans to build a $20-million elementary school after failing to find buyers for $454 million of the county’s construction bonds. In San Mateo County, Calif., officials in 25 school districts are victims of the Lehman Brothers collapse as they face the prospect of recovering a fraction of their investments through the bankruptcy process. In West Hartford, Conn., town officials canceled or sidelined $20 million of planned school-construction projects in light of credit uncertainty.

The situation is bad “all over the place,” says Lee Buffington, San Mateo County treasurer, which lost $155 million, about 40%, of the county's 26 school districts' money invested with Lehman Brothers.

The credit crisis has cast a big question mark over the construction industry, as schools grapple with unplanned-for interest rate hikes on bonds for projects. Maine school officials point to climbing bond interest rates for the delay of major projects this year. Jim Rier, the director of finance and operations for the Maine Dept. of Education, says the state sold bonds this fall at an interest of 5.2% instead of the expected 4.8%. “It is significant over the term of 20 years,” Rier says.

Creative Financing

In the melee are examples of creative financing as schools clamor for project investors. At Oregon University System, school officials have made Herculean efforts to execute its ambitious $1.8-billion capital construction program which includes 140 projects. In Oregon “we have to match bonds one for one by fund raising,” says Bob Simonton, assistant vice chancellor for capital programs at Oregon University System. “For each project, we have to go to the public and raise 50% of the funds.”

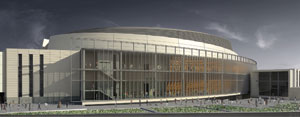

“It can take a few years to raise the funds” for a program that includes 23.5 million sq ft of construction at seven campuses around the state, entailing about 60% renovation projects, 30% new construction and 10% acquisition of buildings, says Simonton. “We have about a $700-million backlog of renovation projects on buildings that were built in the 1960s and 1970s and need electrical and plumbing upgrades and seismic retrofits. [I’m] banging my head on the wall to figure out how to fund it.” Included in projects are a $200-million, as-yet-unnamed school sports arena, for which Nike founder Phil Knight kicked in half the cost, a $48-million education building and a $20-million music-school addition.

When the school came up dry in efforts to raise capital for much-needed infrastructure upgrades, Simonton pressed for new legislation to enable the state to fully bond key projects. “If you have ever tried to raise funds for a new sewer line, you know how difficult that is,” Simonton says. A $42-million project for a new energy plant at the Oregon State University campus in Cornvallis was included in the infrastructure upgrades. With a mere $6 million available for the project, “I had to figure out to leverage that amount to get the project completed,” says Simonton. He came up with a plan to turn the plant into a research center as bio-fuel-burning facility outfitted with an attached classroom. The idea enabled access to state sustainable-energy credits and drew donors from energy and climate trusts, turning a potential albatross into a something donors liked. “It made it much easier raise funds for a powerplant by adding the education and sustainability element to the project,” he says.

The green revolution has found fertile ground in education projects, where owners are particularly eager to embrace the vanguard. Sustainable solutions are spurred not only by rising pressure to be a clean and sustainable neighbor, but for energy-saving, cost-reducing measures as well, owners say. There is a rising trend among towns and cities to mandate green construction on school projects, looking for guidance at both the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) rating system and the Collaborative for High Performance Schools (CHPS) rating systems. CHPS originally was developed for the California school market, but the climate-specific criteria already has been adapted for Washington, Massachusetts, New York and New England states.

New York City officials this year enacted green requirements on all new K-12 projects in the city, and colleges and universities are following suit. At one the largest higher-education capital construction programs in the country, Brooklyn College is focused on the sustainability of its $575-million program to build a new performing-arts center, science complex and gymnasium. “The university made a recent decision that all new buildings constructed are to be LEED certified,” says Brooklyn College spokesman John Hamill. The U.S. House of Representatives approved legislation this summer to put $20 billion towards improving sustainability of school facilities across the nation.

Operations Adjustment

“Sustainability is the biggest change we are going through,” says Simonton. Schools are committing “to be at least LEED Silver or better, and it caused architects to rethink school design.” Simonton says one unforeseen aspect of green is “we have to train operations staff how these high-performance buildings work.” At a University of Oregon campus, a newly built business school features advanced HVAC and thermal systems and a photovoltaic solar array. “It took a year for the facilities folks to figure the building out,” Simonton says. “With green the occupants have to be educated.”

The green revolution has owners working closer with architects than ever before, as they strive to integrate new technologies into designs. Owners “are looking to architects to help them navigate green,” says Richard Nowicki, a partner at San Diego-based NTD Architects Inc. The designer has developed prototype building solutions for owners of K-12 projects in southern California. “There is a huge increase in the amount of technology needed in schools today, it is an ongoing conversation we have with school owners,” says Nowicki. With new technologies hitting the market at breakneck pace, “sometimes owners don’t want us to design systems into the building until the very end of the job,” Nowicki says.

Post a comment to this article

Report Abusive Comment