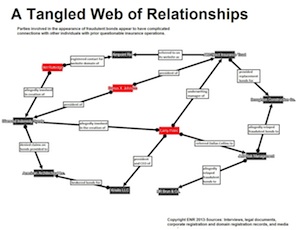

An informal, multi-state network of companies and brokers appears to be involved in fraudulently produced Chubb surety bonds discovered earlier this year and other controversial surety practices, according to interviews with small contractors that have lost premiums paid for the bonds. Exactly who is responsible for the fraud remains unclear.

Obtained in the last 18 months for public-works projects in three states and American Samoa, the bonds cost the contractors about $230,000 in total premiums.

The problem came to light in April, when Chubb informed a Maryland and Washington, D.C.-based contractor, Broughton Construction Co., that bonds issued on its behalf from Chubb subsidiary Pacific Indemnity were not authorized by the insurer. The project involved a $5.5-million Navy museum and visitors center in St. Mary's County, Md.

So far, companies and individuals in the bond procurement chain all say they had no part in the fraud and blame others for the trouble.

Because several individuals served as intermediaries, the contractors aren’t sure who faked the bonds and issued them without Chubb’s approval.

Dallas Collins, owner of Multi-Task Contractors Inc., dealt with one Texas-based broker and another in Chicago before wiring $36,000 to a third company in Atlanta.

“I’m trying to determine if [the first two brokers he dealt with] are involved or are innocent and got taken,” says Collins.

Federal Bureau of Investigation agents have interviewed companies affected by the fraud, the contractors say, but agency officials didn’t respond to ENR inquiries about whether a formal investigation is under way.

Looking for the 'Big Fish'

Based on the information he provided to the FBI, Collins says he believes the agents are interested in “the big fish.”

With Treasury-listed corporate sureties such as Chubb, the line between a broker and underwriter is clear. Corporate sureties and the National Association of Surety Bond Producers (NASBP) point out that shady individual sureties and their brokers often blur the line between broker and underwriter, switching roles when it is expedient.

In April, St. Mary’s County, which is building the museum and visitors center, took steps to replace Broughton as the prime contractor when it learned that Broughton’s seemingly legitimate corporate surety bond from Chubb had been faked.

Broughton’s bonds were arranged with the assistance of JLM Risk Management, an Atlanta-based company that has been a brokerage for other small contractors, according to a source familiar with the transaction who asked not to be named. Broughton paid a premium of $175,000.

Another individual, however, acted as the bond underwriter, says an attorney for JLM Risk Management.

JLM also was involved in another instance of fraudulent Chubb bonds, the ones that involved Dallas Collins in Texas.

JLM invoiced HR Brun & Co., a San Antonio-based contractor, for a surety bond provided on the contractor’s behalf for a $600,000 contact last September. Collins, of Multi-Task Contractors Inc., was serving as a financial partner to HR Brun so that Brun could qualify for the bond.

Collins paid a 6% premium, or $36,000, to JLM before the bonds were issued.

Post a comment to this article

Report Abusive Comment