Four construction industry CEOs were among the 200 best-compensated chiefs of publicly-held companies valued at $1 billion or more on this year's list compiled by compensation consultant Equilar Inc. for The New York Times, based on 2014 proxy statements filed by April 30.

Of those CEOs, one is a newcomer both to the list and his industry firm position, while the other took advantage of improved stock value and a generous long-term compensation package. The data is based on required filings to the U.S. Securities and Exchange Commission (SEC).

Ronald N. Tutor, CEO of California contractor Tutor-Perini, emerged as the industry's highest-paid industry CEO, zooming up the list to No. 39, with a reported $25.5 million in 2014 compensation. Stock and option awards drove the bulk of his pay, up 193% from last year, according to Equilar. The long-term compensation made up about $21.2 million of his total.

The Times reports that the firm's revenue rose 8% last year to $4.5 billion, ranking it at No. 146 on that list component, but that its stock return was down by an equal amount, landing it at No. 171 for that component, with 56% of shareholders voting against Tutor's executive pay.

Leading the Equilar-Times list for 2014 among company CEOs in all areas of business is David M. Zaslav, chief of Discovery Communications, whose total package exceeded $156 million, and was a 368% increase for him from last year, fueled by a long-term compensation bonanza.

Joining the list for the first time at No. 172 is Michael S. Burke, CEO of AECOM, who was elevated to the position in late 2013. His $3-million cash compensation was augmented by more than $10 million in stock and option awards, generated by the firm's 8% stock return propelled by its blockbuster purchase of URS Corp. in 2014 and related acquisition of Hunt Construction. AECOM's revenue rose 2%, says the Equilar data.

Other construction industry names on the Top 200 list are from the equipment sector—Caterpillar CEO Douglas Oberhelman, listed at No. 132 with $15.1 million in total compensation—a 26% increase—says Equilar, and Samuel R. Allen, CEO of Deere, whose $17.1 million in total pay puts him at No. 106. That figure is a 5% drop from last year's number, although the firm's stock return rose 7% for the year.

Energy contractor CB&I paid CEO Philip K. Asherman about $14.28 million in 2014, according to the firm's proxy filed on March 27, although he was not included on the Equilar-NYTimes list. The figure was a 3% total compensation drop from 2013, says the proxy.

Equilar, based in Redwood City, Calif., did not include the firm "because its principal executive offices are based in the Netherlands and they neither have their business or mailing address listed with the SEC at a U.S. address," says Aaron Boyd, the research firm's director of governance. "We do make some exceptions for companies that are incorporated outside the US but are basically US companies, but CB&I didn’t pass that filter."

The firm's share price doubled in value in 2013 after its purchase of The Shaw Group. Asherman's compensation had been fueled by a stock component that made up 57.4% of the total and rose 70% from the year before.

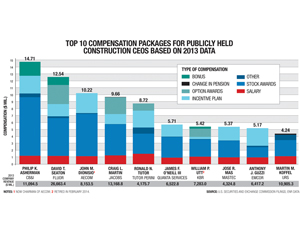

The 10 most highly compensated CEOs last year enjoyed incentive and non-incentive stock awards ranging from 28% to nearly 60% of total pay, according to ENR's analysis of 2013 SEC compensation data. Total pay for MasTec CEO José Mas rose to $5.3 million in 2013 from $481,380 in 2006, as the firm's revenue reached a record $4.3 billion last year and earnings zoomed to $449 million from $60 million in 2007.

ENR also found that only EMCOR paid CEO Anthony J. Guzzi more in cash, with just $1.47 million, or 28.4%, of the total in stock for 2013. Most of his compensation was from the firm's incentive program, which embraces a pay-for-performance approach.

"Companies recognize that CEOs, the top dogs, determine the success or failure of the firm, so they're kind of doing what they have to," says industry recruiter Frederick Hornberger. Andrew Wittman, E&C sector analyst at Robert W. Baird & Co., says some compensation packages "encouraged acquisition activity."

SEC data for 2013 also includes Tutor Perini's Tutor's 150 hours of personal use of the firm jet valued at $800,000, with former URS chief Martin M. Koffel awarded $560,000 for personal security, which the firm's directors required due to "business-related" threats. "There still are some nice perks at the executive level ... but, long term, most of that is down," said Wittman.

Koffel, who retired from the firm after its purchase by AECOM, earned 34% less in 2013 than in 2010, reflecting weaker-than-expected URS results. His pay also reflected fluctuating incentive-based awards since 2007.

Post a comment to this article

Report Abusive Comment