The market for professional services in the construction industry has taken a beating, just like every other aspect of the depressed industry. However, unlike contracting, design and project delivery, the need for professional services from such firms is not always tied directly to specific projects but can range from project and program development to staff augmentation and dispute resolution. Thus, the downturn in projects does not directly correlate to a downturn in the need for services.

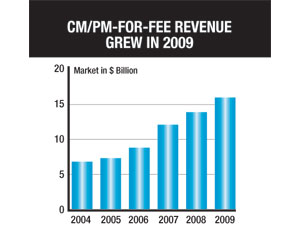

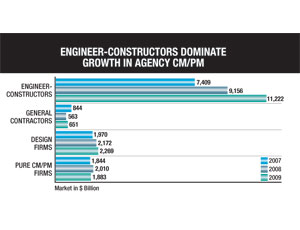

This demand can be seen in the numbers from this year’s ENR Top 100 CM-for-Fee Firms survey results. The Top 100 generated a surprising $16.03 billion in fees in 2009 for construction management and program management services, up 15.3% from $13.90 billion in 2008. However, most of this growth came from the large engineering-construction firms that manage huge federal, industrial or power programs. For other types of firms, fee levels were essentially flat or down.

Some see the current conditions as often helping CM firms. “Many owners want to be able to get their projects to market as soon as possible to beat inflation,” says Bruce D’Agostino, CEO of the Construction Management Association of America, McLean, Va. This means they are willing to try alternate project delivery, but most owners are not experienced in how to proceed, he says. “They have to realize that they can’t just pull a contract off the shelf. They need the expert advice that a CM firm can provide.”

D’Agostino notes that CMAA’s CM certification program has helped boost interest in the organization. “Anyone can call themselves a CM firm, but owners increasingly are looking to our certification as a qualifying criterion.” This reality has caused a scramble to get professionals certified. “Our program is nearly double what it was last year,” he says.

For many top firms, the last two years have been rough going. “We took a double hit, not just from the national downturn but from the budget woes in California’s public-sector markets,” says Guy Erickson, CEO of Harris & Associates. He says the firm is down 40% from its high point in 2008. “This is the starkest market I have seen in 40 years.”

However, Erickson says the firm has adapted, and there are good opportunities. “We have learned to be more entrepreneurial,” he says. The firm is becoming more involved in different project delivery methods, such as CM-at-risk and integrated project delivery, which it used to avoid. He also says the firm is exploring new markets, such as high-speed rail and solar farms.

In some cases, geography has provided a boost for firms. “In D.C., there is a lot of opportunity, but that is mostly related to government work and some stimulus projects,” says Christine Merdon, senior vice president of McKissack & McKissack. The firm is working on the new U.S. Coast Guard Headquarters, part of the $4-billion Dept. of Homeland Security complex at the St. Elizabeth’s Hospital site in Washington, D.C. It also is working on the proposed Martin Luther King Jr. and Eisenhower memorials, also in Washington, D.C.

Through the recession, Hill International has continued to grow and has expanded internationally. “We are fortunate that 85% of our domestic work is in the public sector,” says David Richter, president. He says the market is improving incrementally on a quarter-by-quarter basis, but he doesn’t expect a major turnaround until 2012. “The recession will leave a one-year hole in everybody’s backlog,” he says.

Federal spending has helped many firms weather the storm. “The federal sector has a bunch of money, and for firms that have at least five years’ experience in that sector, the market is good,” says Blake Peck, CEO of McDonough Bolyard Peck Inc. His firm continues to work on such huge projects as the new Walter Reed Army Medical Center in Bethesda, Md., and the expansion of Fort Benning’s Armor School in Georgia.

Another firm that has been able to stay the course because of its markets is Broaddus & Associates. “We have kept to the health-care, institutional and higher- education markets,” says Jim Broaddus, CEO. “We have found that many clients will hire us for one job and then bring us in on their subsequent projects,” he says.

Pinching Pennies

For some CM firms, competition is having an impact on price. “Clients are always looking to get the most for their money,” Merdon says. But competition has ramped up as new firms enter the market, particularly architectural and architect-engineering firms, she says. Broaddus agrees new competitors are appearing, including property management firms. This competition has resulted in some clients pressuring CM firms about fees.

Richter agrees some U.S. owners are becoming more price-sensitive as the recession lengthens. “But you get what you pay for,” he says. It is better to choose a CM or PM based on expertise rather than price, as their services are such a small portion of the overall project budget, Richter adds.

Some firms are beginning to see some signs of recovery but worry that global economic issues may delay a turnaround. “Credit is becoming more available to clients and businesses,...

Post a comment to this article

Report Abusive Comment