..., in the current downturn, almost every nuclear plant fits that description, Prabhu says. “At this point, given the risks of the nuclear units, capital markets don’t have the appetite to fund these units,” he says.

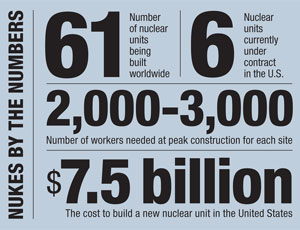

In a report issued this year by Standard & Poor’s, Prabhu and his fellow analysts say if natural-gas prices stay below $6 per mmBtu, natural gas will remain the fuel of choice for new electricity and new nuclear plants will be difficult to build without additional loan guarantees. S&P points to the massive up-front investment—at least $7.5 billion per unit—which can be a huge drain on utilities, even those with a solid balance sheet and cash flow, such as Southern.

S&P says that, in other places in the world, nuclear power can be developed because the governments own the utilities developing the plants. In the U.S., the Obama Administration has proposed another $54 billion in DOE loan assistance.

“I think a couple of stars are not aligned for the U.S. renaissance,” says Carl Rau, president of the nuclear power division of San Francisco-based Bechtel. “The costs are higher than anticipated, there’s lack of a cohesive energy policy, [and] the loan guarantee program is much more onerous to the contractor and utility. Until the first [few] plants are built,” development in the U.S. will be slow, he says.

Despite the expense of financing nuclear plants and the unresolved issues of what to do with nuclear waste, Southern and others utilities remain bullish on nuclear power. Bernhard says Shaw is looking out for the long-term. He says Shaw’s investment in nuclear construction will be “OK in the short run, great in the medium term. In the long term, it will be the greatest investment this company has ever made.”

However, the current lack of a permanent nuclear waste facility gives none of the executives pause. While groups such as Greenpeace and the Southern Alliance for Clean Energy oppose the nuclear facilities, they focus not only on the waste but also on the riskiness of nuclear ventures, especially when subsidized by U.S. taxpayers.

Although no new units have been built from the ground up in 20 years, U.S. nuclear contractors have kept busy with operations, maintenance and major plant modifications on the 104 nuclear units—adding close to 3,000 MW of capacity in the last decade alone. TVA completed Watts Bar in 1996 and restarted Browns Ferry Unit 1. TVA is spending $2.5 billion to restart Watts Bar Unit 2, with Bechtel as the engineering, procurement and construction contractor.

“What we tend to refer to as a renaissance in the U.S. is not really that—we’ve been actively servicing and relicensing and adding capacity continuously over the last 20 or 30 years,” says Chris Tye, senior vice president of nuclear build at Fluor.

Further, the companies are keeping busy on worldwide projects. Outside of the U.S., 61 new nuclear plants are being built—most of them in China.

China currently plans to bring on seven to eight new nuclear units a year, which adds up to about 70,000 MW of new power coming online by 2020, says Aris Candris, Westinghouse Electric president and CEO.

Don Gillispie, CEO of Alternate Energy Holdings Inc., which is trying to build a merchant nuclear plant in Idaho, recently lambasted regulators for contributing to the U.S. nuclear industry falling behind other countries in building new nuclear reactors. “We are missing out on the best source of energy for the future,” he says.

Lessons in Regulation

The companies that expect to build nuclear plants in the U.S. say they are cutting their teeth on these new reactors, refining their technologies and construction methods.

“That’s the beauty of what Areva is doing,” says Michael Rencheck, chief operating officer of Areva Inc., which is building its ninth new generation reactor. “We’re in the position to provide some very good experience,” he says. “We are using lessons learned for feedback in the U.S.” Those lessons have been costly for Areva, which is facing almost $3 billion in cost overruns at its Finland-based Olkiluoto plant due to labor issues and regulatory hurdles.

The fact that lessons from the past are being shared between sites, countries and even companies is a crucial difference between then and now.

Those involved with the industry argue that the dramatic changes to the industry over the past 20 years will enable new units to be built on budget and on time. Plant Vogtle’s units Nos. 1 and 2, proposed in 1970 for $660 million, went online after 15 years of construction in 1987 and 1989, respectively, and cost $8.87 billion in total to build. The company blamed the cost overruns on inflation and excessive regulation. But inefficiencies, a design-as-you-go approach and lack of communication also contributed to the problems.

All those issues—licensing, design and construction—have been addressed by regulators and an industry that does not want a repeat of that experience.

“You can look at the period that nuclear was really in decline—the mid-1980s and late 1990s—we used that opportunity to rethink the whole process,” Candris says.

Most important, the new reactors have standardized designs. In the last round of construction of nuclear plants, each unit was different, and the designs were developed as construction happened.

“We were making up designs as we went along,” says Candris.

The new reactors under consideration and construction are called Generation III reactors. They are standardized, efficient and have passive safety systems, Candris says. In the case of the AP1000s at Plant Vogtle,...

Post a comment to this article

Report Abusive Comment