Cross London Rail Links

|

Keener competition for construction contracts might have been one positive feature of the global economic slowdown that could have eased the procurement of London’s $30-billion Crossrail transportation project. But with other mega jobs now taking off, London may not be a buyer’s market for one of Europe’s biggest projects. “The procurement program... has to be developed to take account of the demands being placed on the market by other major programs of work,” says Steve Rowsell, head of procurement at Cross London Rail Links Ltd. (CLRL), the project’s owner.

Rowsell cites preparations for the 2012 London Olympics, the vast Tideway storm-surge tunnel along the Thames River and widening of the city’s M25 beltway among projects competing with Crossrail for resources.

Building 21 kilometers of railroad tunnels and underground stations below London and linking them to existing transportation networks and utilities are among Crossrail's other major challenges, says Rowsell. Conceived two decades ago, the Crossrail project completed its tortuous gestation this summer, when Cross London Rail Links secured final approvals.

|

| OAKEERVEE |

Within weeks, the company issued bid invitations for key management and design contracts, ahead of procuring works packages next year. Up to 14,000 people will work on Crossrail at peaks, estimates Douglas Oakervee, CLRL executive chairman.

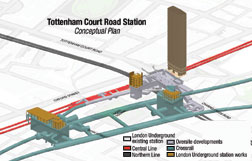

Crossrail will, from 2017, link railroads from either side of London with twin 6-meter-dia tunnels. The tunnels will be served by new mostly underground stations at seven key interchanges with mainline railroad and metro systems. Peter Hendy, London’s transport commissioner, estimates the project will raise the city’s public transportation capacity by 10%, carrying 200 million passengers a year.

Among procurement options CLRL last year ruled out for Crossrail was wholesale design-build, says Oakervee. His market probing revealed little contractor appetite for that approach.

| + click to enlarge |

Cross London Rail Links

|

Cross London Rail Links Crossrail will involve building 21 km of rail tunnels and seven stations.

|

Applying traditional design-build to the civil work “would have placed high risks on contractors and it would not have been likely to attract strong competition,” adds Rowsell. Also, “it would have been very difficult for contractors to find the design resources needed,” he says.

CLRL is mixing its approach, using design-build for railroad, station, mechanical and electrical systems, explains Rowsell.

“Civil contracts for the tunnels and stations will generally, but not exclusively, be based on an [owner-procured] design with the contractor involved to review and optimize the design for buildability and value before it is finalized,” adds Rowsell.

Before CLRL starts signing contractors, it must establish its own operations. Now equally controlled by Transport for London and the central government’s Dept. for Transport, CLRL will become wholly owned by the city early next year. However, CLRL’s non-executive chairman, when appointed, will report to both organizations. The agencies are now recruiting for chairman and soon CLRL will start hunting for its own chief executive. Oakervee, who led the project through its formative three years, will pull out when the two top appointments are made.

|

| ROWSELL |

Among CLRL’s key early appointees was Rowsell, a veteran of 30 years government service. As procurement director at the highways agency, “we developed and implemented a radically new procurement strategy for...major projects and the maintenance and operation of the strategic road network,” he recalls. Now, CLRL plans to appoint a program partner to “work alongside as part of an integrated client team to manage the overall program.”

Of four teams shortlisted for the job, Bechtel Ltd. and Mouchel Ltd. are bidding alone. Parsons Brinckerhoff Ltd is teamed with Balfour Beatty Management Ltd. AECOM is bidding with CH2M Hill Cos. and Nichols Group Ltd. Most of these firms plus others are among five groups bidding for the Deliver Partner contract, to help manage design and construction of the tunnelled central section.

| + click to enlarge |

|

At the same time, CLRL is procuring design firms to develop the outline schemes that are now being completed by four design teams.

Bids for an unspecified number of “framework agreements” were due in late September from 15 firms, including most of the U.K.’s. big names. “Framework consultants will be selected for design packages using secondary competitions,” says Rowsell.

With management and design contracts due to be let by early next year, CLRL’s next procurement campaign will be for works packages, each typically valued at above $470 million, estimates Rowsell.

“It is likely that there will be at least three major tunnelling contracts and six station contracts, together with contracts for other elements of the project,” he forecasts. The procurement process for contractors will begin next year followed by the main bidding in 2010.

Related Links:

Related Links:

Post a comment to this article

Report Abusive Comment